Set Up Account Alerts

Receive text or email alerts when your balance is getting low or a large purchase is made. Log in to Online Banking or the Mobile Banking App to set up account alerts.

Affinity is committed to supporting you along your financial journey, even when things don’t go as planned. That’s why we offer multiple layers of coverage to protect your checking account from overdrafts. Review the options below to make sure you’re covered.

Qualified Affinity checking accounts are automatically enrolled in Standard Courtesy Pay, which is a service that allows us, at our discretion, to pay covered transactions that exceed your available balance and cause your account to be overdrawn.

We charge a $33 Insufficient Funds Fee per transaction that overdraws your account.

There are no enrollment fees or other costs associated with this option.

Qualified checking accounts are automatically enrolled in this account feature, so no further action is needed.

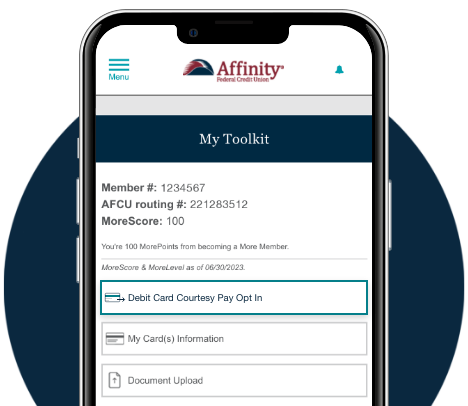

Debit Card Courtesy Pay is an optional service you can opt in to that allows us, at our discretion, to pay debit card purchases and ATM withdrawals that exceed your available balance.

If a transaction that exceeds your available balance is less than $75, we do not charge a fee. For transactions of $75 or greater, the fee is $15 per occurrence. There are no enrollment fees or other costs associated with this option.

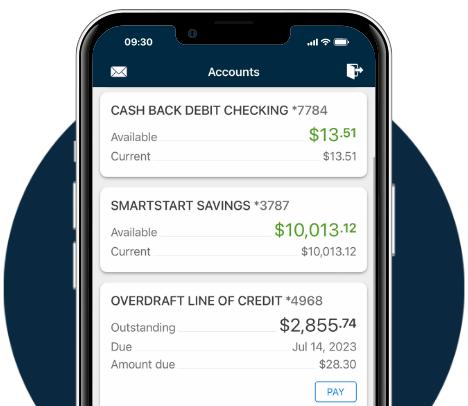

The Overdraft Protection Plan is an optional feature that lets you link your checking account to another eligible Affinity account, such as a SmartStart Savings account. If a transaction exceeds your available checking account balance, we will automatically transfer available funds from the linked account to cover the transaction.

If your checking account is overdrawn and you have sufficient funds in the linked account to cover the transaction, there is no fee for the transfer made from your linked savings account to your checking account. If you do not have sufficient funds in your linked savings account, Affinity may, at our discretion, cover a transaction through Standard Courtesy Pay or Debit Card Courtesy Pay (if you have expressly opted in). Fees may apply for transactions covered by Standard Courtesy Pay1 or Debit Card Courtesy Pay2.

Apply for a Checking Overdraft Line of Credit to automatically transfer funds to your checking account in the event of an overdraft. There are no application fees, and you only pay interest on the amount you use with your line of credit.

You only pay interest on the amount you use with your line of credit.

Receive text or email alerts when your balance is getting low or a large purchase is made. Log in to Online Banking or the Mobile Banking App to set up account alerts.

No, if you do not opt in to Debit Card Courtesy Pay, Affinity will decline debit card purchases and ATM withdrawals that exceed your balance, and no fees will be assessed by Affinity.

Yes, the Checking Overdraft Line of Credit is a loan, which is subject to credit review and approval.

Yes, you can opt out of Standard Courtesy Pay by calling us at 800.325.0808. Opting out of Standard Courtesy Pay will result in the transaction being returned. A $33 Insufficient Funds Fee will be charged for each returned transaction.